13F Finds - 2024 Q1

Autozone, Monday.com, Waste Connections

I really enjoy sifting through 13F filings that come out once a quarter. For someone not directly immersed in the investment industry, it offers a rare glimpse into a fund’s ideas, position sizing, and concentration levels. Any institutional manager with more than $100M in AUM is required to file quarterly reports of holdings. However, there are some major caveats when looking at these filings.

These are a point in time snapshot and are reported on a 45-day lag. Therefore, it may be impossible to glean any insight from funds with rapid turnover.

The activity (buying or selling) occurred during a three-month window. If there exists a wide range that a stock traded at during that period, it may be challenging to infer the ballpark prices a stock was bought or sold.

These only disclose domestic exchange public equity positions. No short positions, international positions, or private equity positions at a crossover fund. For funds that short, positions may or may not be hedges against other investments. And excluding international positions and private equity positions can skew the overall portfolio picture and conclusions about concentration levels and conviction.

There are many examples of funds I will scan through but be unable to take much away from. Often these are investors who I typically enjoy and have learned from greatly. Take Mohnish Pabrai. His fund is very concentrated but has lots of international exposure, namely Turkey/India/China. It may be interesting for idea generation, but it’s hard to conclude anything about his aggregate portfolio. Then there is Tom Gayner at Markel, dubbed the “Baby Berkshire.” I love listening to his longform interviews, but his 13F has 100+ positions, typically has very small adds, and he very rarely sells anything as cashflow from Markel is used to grow the investment portfolio. This resembles an index fund and provides less signal. Michael Burry (Scion Asset Management), of Big Short fame, is a true independent thinker and very value oriented. But his portfolio changes so rapidly. There are drastic differences in positions/weightings just quarter to quarter, and with the lag in 13F information, makes it challenging to take much signal from. Or take Jim Chanos, famous Enron short-seller, and his now closed down Kynikos fund. Any position listed in that fund was simply a long hedge against something he was shorting. So, interesting to look at but not that useful ultimately.

So, what type of funds do I find the most interesting to dissect 13F filings?

Concentrated portfolios – ideally 50%+ in the top 5-8 positions.

Primarily domestic and long only (or minimal shorting).

Low turnover – the fewer changes the better, although funds with near zero activity for years at a time are less interesting, albeit quicker to scan (e.g. Punch Card Management).

Some kind of public presence or information regarding strategy. This can be investor letters, interviews, podcasts, etc. The longer the 13F track record this less important this may be.

Relatively small AUM. This gives a fund the opportunity to consider small market cap ideas. There are a lot of larger funds I also follow (Polen, Berkshire Hathaway, Akre, Pershing Square, TCI) but their massive size means they are typically limited to larger market cap ideas.

Some similarity in stocks I hold or am interested in. It’s very easy on whalewisdom.com to search by ticker and find funds with positions.

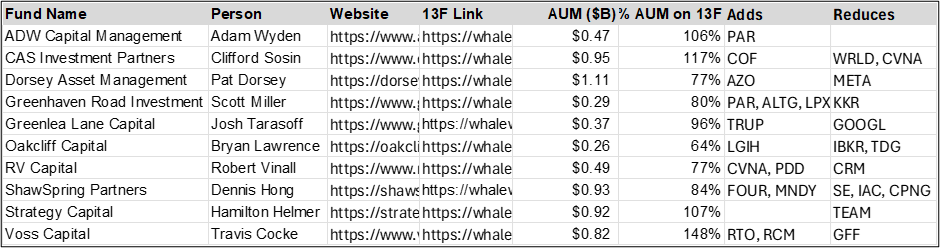

Here is a subset of funds I currently am checking on a quarterly basis:

Interesting finds from 2024 Q1:

Dorsey buys Autozone ($AZO):

Pat Dorsey has been running a fund for about 10 years that checks all my boxes above. He has written a few books on investing as well as published presentations on competitive advantages and capital allocation. His focus is on strong moat companies. The funds positions are concentrated, held for a long time, and typically only have a couple changes per quarter. So, when a new 8% position in Autozone showed up this quarter, I was interested.

Autozone is one of those business stories that many people know, but never decided to invest in. The stock has been an amazing compounder at nearly 20% CAGR for the last 20 years. This is driven by consistent 3-4% store count growth and SSS expansion yielding a 6% revenue CAGR. Improved profitability with scale has driven an 8% CAGR in operating cash flow. Thanks to consistent cash flow and negative working capital, the company has gobbled up shares, averaging 8% per year. This combined with a little multiple expansion gets the stock to a 20% CAGR.

The durability of the business has frankly been super impressive. Questions about the moat from Amazon or electric vehicle penetration hurting sales have kept the multiple reasonable and enabled the company to buy back more shares. Those same questions remain today but the stock could still do well for a long time.

Shawspring buys monday.com ($MNDY):

I was drawn into following Shawspring because they are well versed in Asian technology companies, namely ecommerce and marketplace type models. Dennis Hong has a very minimal public profile, but I was quite impressed after listening to a few of his conversations a couple years back. His fund is very concentrated with typically less than 10 positions and long hold times. There is often trimming/adding to positions but only a couple new ideas show up each year. This quarter a new 13% position in monday.com showed up that looked noteworthy.

I wrote a bit about MNDY recently here so nothing new to add for now. This feels like the third real foray for Shawspring into SAAS, following Snowflake (no longer holds) and Intuit, so will be interesting to monitor going forward.

Stockbridge increases Waste Connections ($WCN):

Stockbridge is the public investing arm of PE company Berkshire Partners. I don’t know much about them, except for listening to Rob Small on the 50X podcast. But their 13F is very interesting – concentrated, diverse industries, long holding periods, and not a ton of changes. They have held some great compounders for a long time – TDG since 2010 and AMZN since 2016 are the top two positions currently. In the last two quarters they have now built Waste Connections up to an 8% position.

The waste industry is one of those I regret not studying earlier in life. The industry has irreplaceable assets (landfills) that are guaranteed to be needed for many years to come. The oligopolistic structure – most local geographies only have a couple competitors – gives companies consistent pricing power. Long term commercial and municipal contracts make this a high recurring revenue business that should grow with GDP. The four major national companies have slowly been acquiring private regional players but ~50% of the market remains for potential consolidation. Scale, density, and their capital investments only make them harder to compete with in the future. WCN is considered the best operator of the bunch and targets primarily secondary/rural markets, but this means they also trade at the highest valuation. There is even an ESG aspect to the industry now with renewable natural gas (RNG) projects in high demand.

Disclosure: Not investment advice. I own shares in MNDY. I am an individual investor seeking to study businesses, continuously learn, and find the best investment opportunities. The Sutherland Woods are a small piece of forested conservation land near my house.