Summary:

I added about 15% to my Monday.com position recently at $185. It is a smaller position for me, but I have owned shares since 2022. I sold some Floor & Décor to fund the purchase as I believe the multiyear return with Monday will be much higher. There is a very reasonable path for the share price to double in three years (26% IRR) with a 32X forward FCF multiple (currently 37X) of my 2028 estimates. Applying a more conservative 24X multiple still yields a 16% IRR. If growth slows significantly there will likely be notable upside to FCF margins. Monday is valued like an average software company whereas its growth, FCF margins, and efficiency are all elite.

Background:

Monday is a platform that helps run core work processes and they dub this a “Work OS.” Essentially it is a low-code/no-code platform that provides the building blocks for integrations and communications to make work for knowledge workers run more efficiently. Recently they have rolled out products on top of the platform targeting specific areas – Monday work management, Monday sales CRM, Monday dev, and Monday service (coming in late 2024). Additionally, they have products to complement the platform – canvas and workforms – as well as an app marketplace where external developers have built solutions for specific use cases.

Originally started as a small department in Wix, Roy Mann experienced difficulties in managing team workflows and started building an internal solution for work communications. (Note: this is remarkably like the Asana origin with Dustin Moskovitz/Facebook) Shortly thereafter, in realizing the vast potential of these concepts, he and Eran Zinman decided to branch out and start a new software business with an initial $1.5M in seed funding in 2013. A year later they only had 6 paying customers, but growth really took off in 2014 with over 500 customers by year end. With more funding rounds the next few years the business continued to expand rapidly with a mobile application, global offices (NYC was the first one in 2018), rollout of 10+ languages, surpassing 100,000 customers, and then an IPO in mid-2021.

The key value proposition for customers is ease of use and customization, productivity improvements, and enabling data driven decisions. Monday highlights the main criticism of traditional enterprise software being complexity, implementation burden, and lack of flexibility for customization. They compete with a range of entities including Asana, Smartsheet, Notion, and Trello in work management and numerous others in CRM software. Monday often lands with a small company or team/department and expands via seats as the efficacy and stickiness permeates throughout an organization. They commonly emphasize how 70% of their customers are in non-tech industries and most new deals in work management are greenfield (displacing basic email/excel solutions) so there truly is a wide array of customer interest. And even though they came to life focused on SMB, 61% of the Fortune 500 is now a customer (albeit with <1% seat penetration).

Financials:

Monday ended 2023 with more than $800M in ARR, a 4X growth in three years. Growth has slowed drastically though from 89% year over year in Q4 2020 to 35% in Q4 2023. There is $1B in net cash on the balance sheet and the company trades at an enterprise valuation of around $8B currently.

Monday has always beaten their financial guidance which implies conservative projections. Their first public quarterly report was Q2 2021, and the high-end annual guide was $282M, but full year revenue ended at $308, a 9% beat. Initial 2022 guidance was $475M and it ended the year at $519M, a 9% beat. Initial 2023 guidance came in at $693M and they ended the year with $730M, a 5% beat.

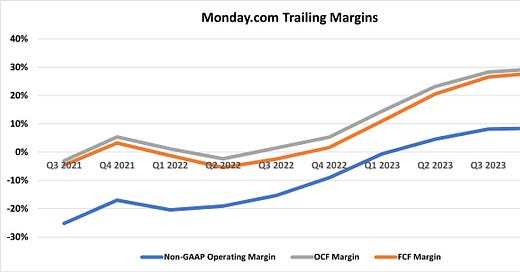

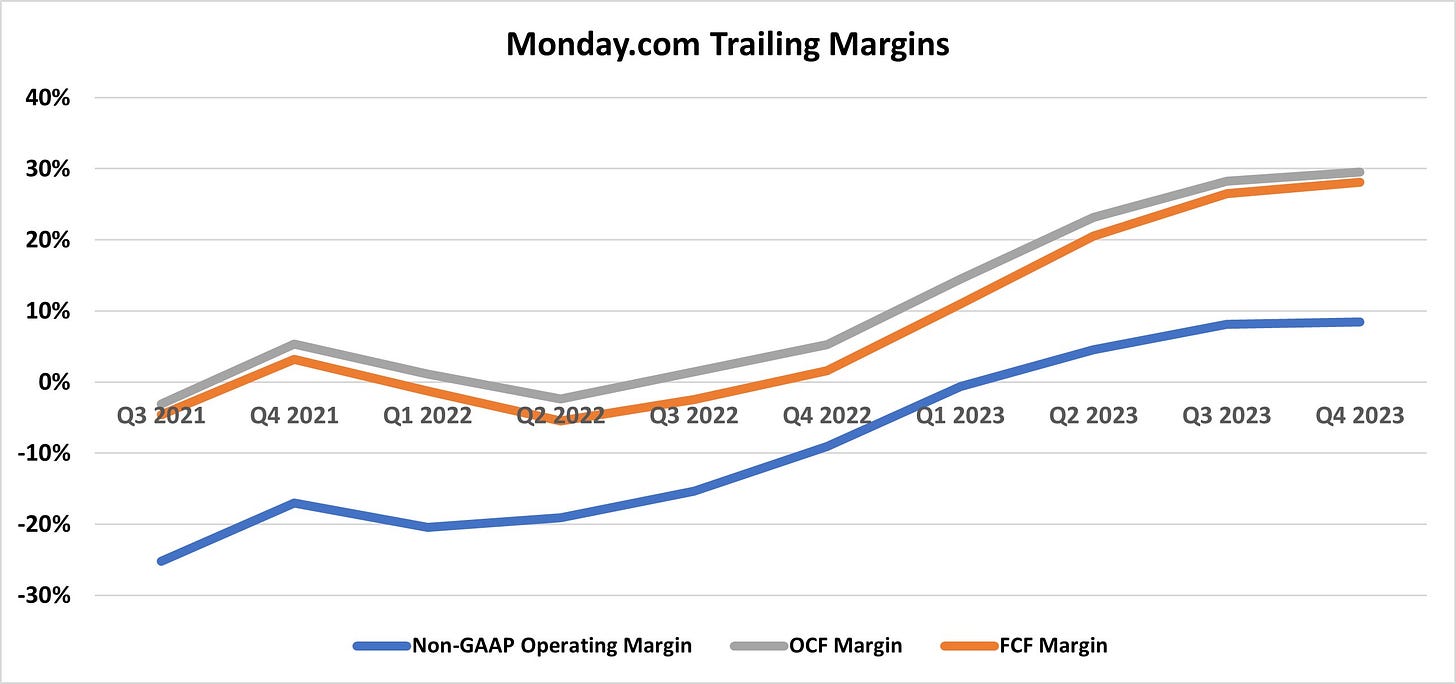

They have shown great operating leverage. Since Q3 2021, trailing GAAP operating margin has gone from -60% to -5%. Non-GAAP operating margin (excludes stock-based compensation) has gone from -25% to 8%. The trailing free cash flow margin has risen from -5% to 28%. With most subscriptions under yearly billing the cash in flow occurs prior to revenue recognition.

Their unit economics are very sound. Monday’s early history was SMB centric and used primarily performance marketing (Google, Facebook, etc.) to attract self-serve customers but that has shifted to more sales and partner channels as the company moves up market targeting larger enterprises. Since IPO, the cost to book (S&M) a new dollar of ARR has been about $1.50 - $2.00, although recently towards the higher end. The cost to service a dollar of revenue (COGS + R&D + G&A) has been improving and recently hit $0.45 on a GAAP basis and $0.35 on a non-GAAP basis.

I don’t have any specific knowledge about gross retention, and the company is quite young, but assuming a 5-10 year customer lifespan, these unit economics imply a 20-30% ROIC. This would be higher if a positive net revenue retention was also factored in, which Monday has exhibited. These also imply that if the company were to slow growth drastically and reduce S&M spend, then FCF margins could very easily be in the high 30’s.

Valuation & Thoughts:

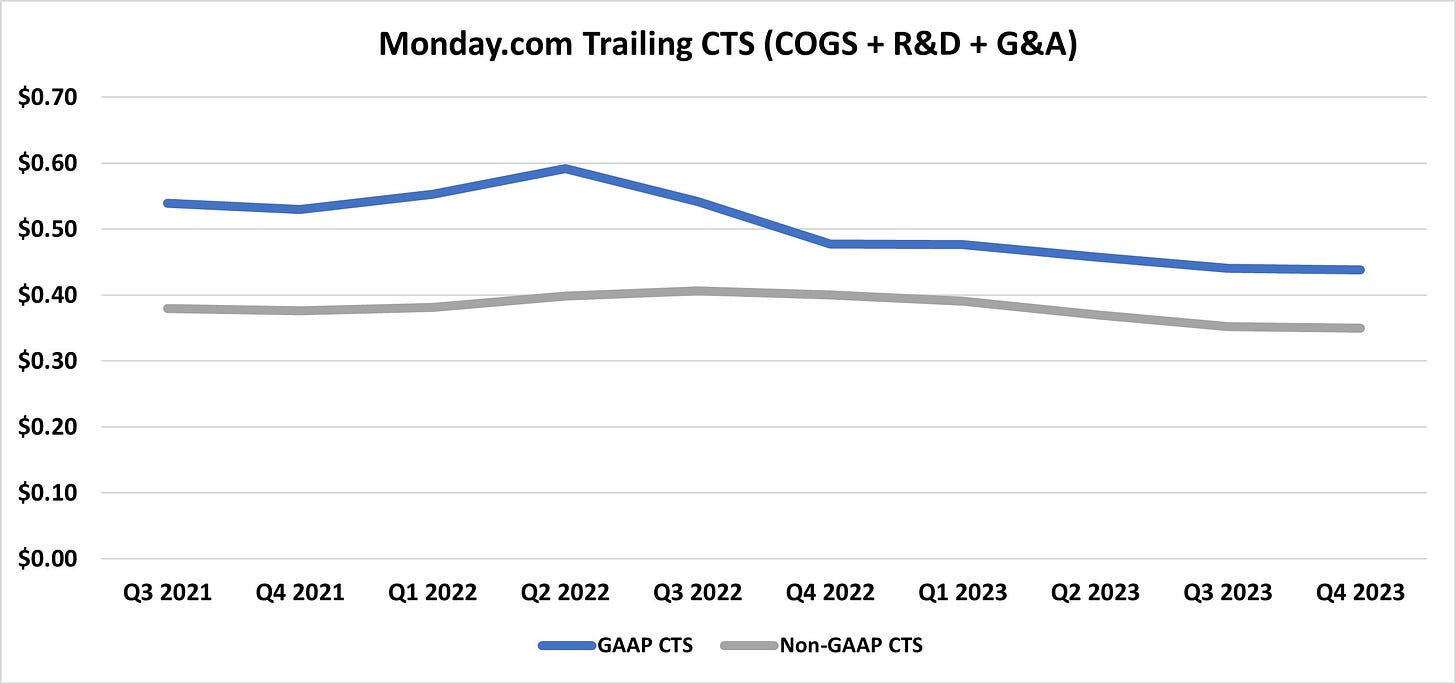

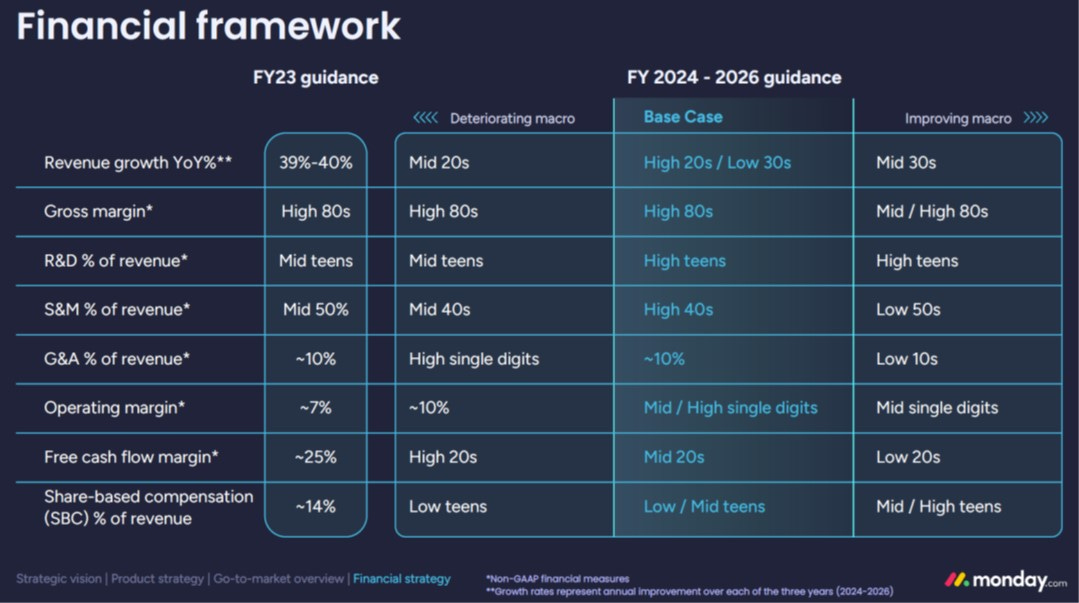

Initial guidance for 2024 revenue came in at $932M and assuming a 3% beat of that, I’m looking for $960M in revenue this year or 32% growth. With some slowdown going forward, that could look like $1.56B in 2026 and $2.3B in 2028. Monday did their first investor day last December and provided guidance out to 2026 (note: they’ve always been conservative) of “high 20s/low 30s.” My projections imply a 29% CAGR through 2026 and then 21% for the two years following.

Monday also projected $1B in FCF over 2023 – 2026, so assuming minimal M&A they should have $1.8B in cash by 2027 and a forward (2028) estimate of $575M in FCF. Putting a 32X multiple yields a 26% IRR and a 24X multiple yields a 16% IRR. I’m assuming 54M outstanding shares or a little over 3% annual dilution.

The biggest questions surrounding the future for Monday revolve around the strength of their moat and competition. Although the opportunities are vast and wide, that also makes it difficult to feel confident in their competitive positioning, and their multiple already reflects that somewhat. Monday might not deserve the elite multiples of platform SAAS like ServiceNow or Crowdstrike, or niche vertical market SAAS like Veeva or AppFolio, but these assumptions are conservative in my mind. Especially for a company that may still be growing revenue 20%+ in a few years with latent margin potential. Some may think Monday might be a great acquisition target for a larger player like Google, Salesforce, or Microsoft, but I think Roy and Eran are really enjoying building something substantial and want to continue doing this for many years. There is tremendous opportunity to continue building the platform and product offerings, while having flexibility for small acquisitions and potential share repurchases (recently mentioned as a long-term consideration).

On an unrelated note, there are some interesting funds that own the stock. WCM recently bought 6.6% of the company in Q1 2024. Strategy Capital – run by Hamilton Helmer, the author of Seven Powers – owns a 5% position in Monday. Greenlea Lane Capital (Josh Tarasoff), a unique and concentrated investor, also has a 5% position in Monday.

Disclosure: Not investment advice. I own shares in MNDY. I am an individual investor seeking to study businesses, continuously learn, and find the best investment opportunities. The Sutherland Woods are a small piece of forested conservation land near my house.